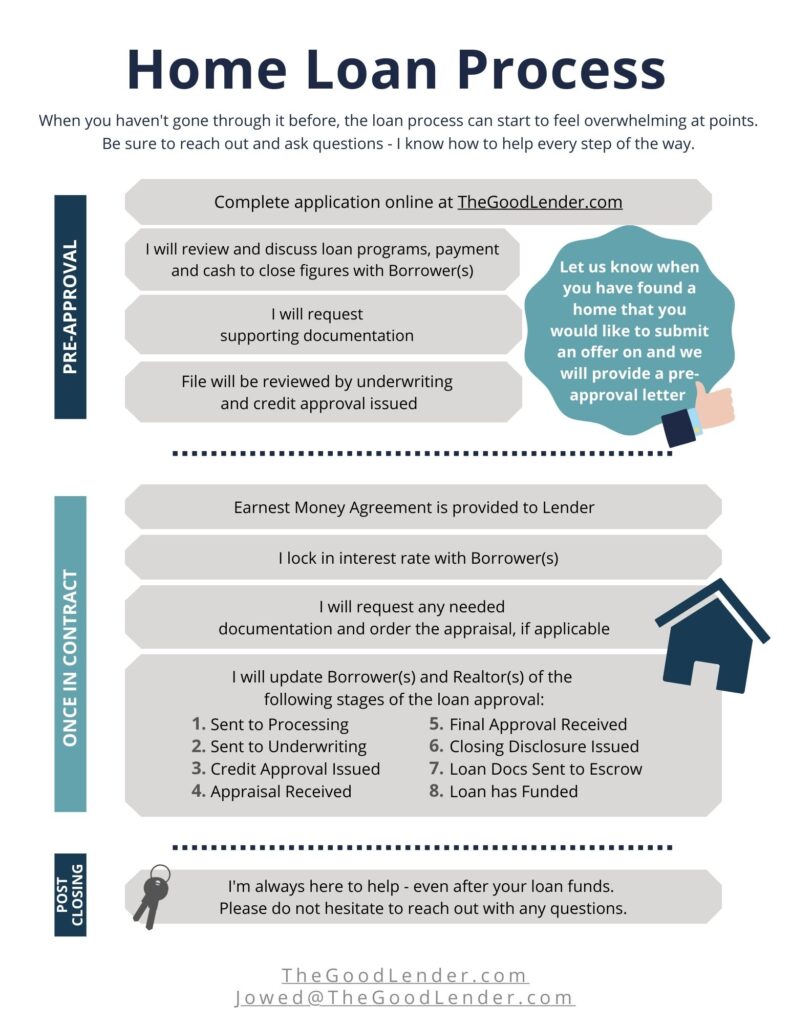

Home Loan Process

When you haven't gone through it before, the loan process can start to feel overwhelming at points. Be sure to reach out and ask questions - I know how to help every step of the way.

Complete application online at HadeedLending.com

I will review and discuss loan programs, payment and cash to close figures with Borrower(s)

I will request supporting documentation

File will be reviewed by underwriting and credit approval issued

Let us know when you have found a home that you would like to submit an offer on and we will provide a pre-approval letter

Earnest Money Agreement is provided to Lender

I lock in interest rate with Borrower(s)

I will request any needed documentation and order the appraisal, if applicable

I will update Borrower(s) and Realtor(s) of the following stages of the loan approval:

- Sent to Processing

- Sent to Underwriting

- Credit Approval Issued

- Appraisal Received

- Final Approval Received

- Closing Disclosure Issued

- Loan Docs Sent to Escrow

- Loan has Funded

I'm always here to help - even after your loan funds. Please do not hesitate to reach out with any questions.

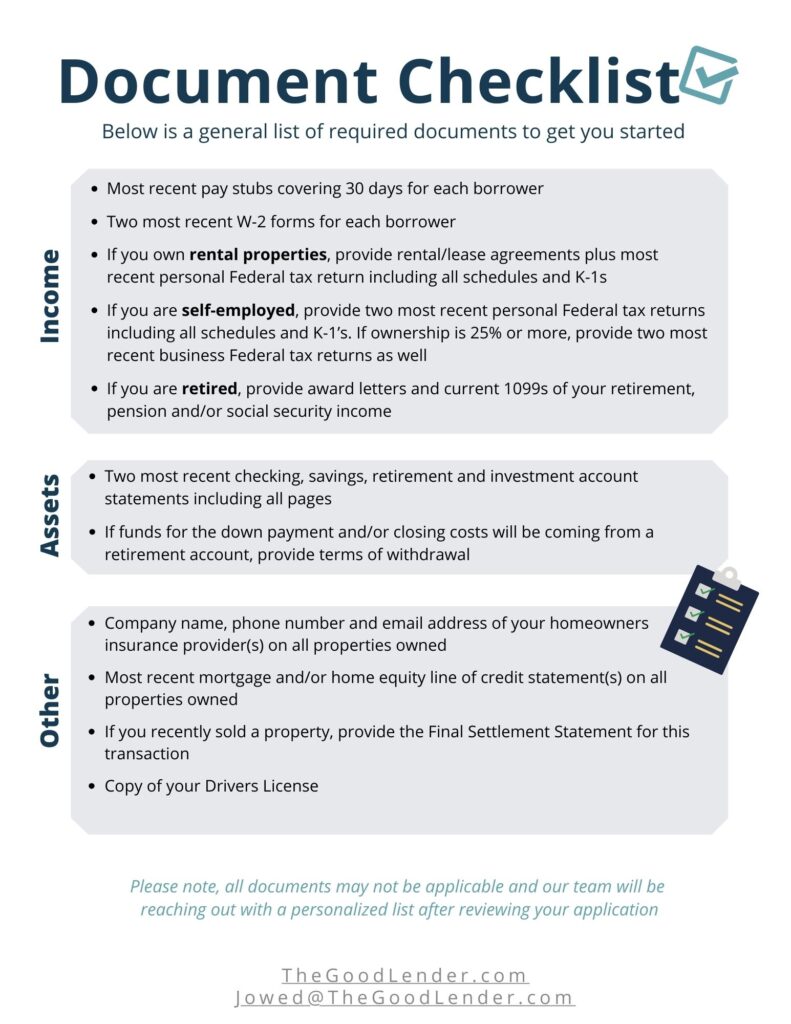

Document Checklist:

- Most recent pay stubs covering 30 days for each borrower

- Two most recent W-2 forms for each borrower

- If you own rental properties, provide rental/lease agreements plus most recent personal Federal tax return including all schedules and K-1 s

- If you are self-employed, provide two most recent personal Federal tax returns including all schedules and K-1 's. If ownership is 25% or more, provide two most recent business Federal tax returns as well

- If you are retired, provide award letters and current 1099s of your retirement, pension and/or social security income

- Two most recent checking, savings, retirement and investment account statements including all pages

- If funds for the down payment and/or closing costs will be coming from a retirement account, provide terms of withdrawal

- Company name, phone number and email address of your homeowners insurance provider(s) on all properties owned

- Most recent mortgage and/or home equity line of credit statement(s) on all properties owned

- If you recently sold a property, provide the Final Settlement Statement for this transaction

- Copy of your Drivers License

Please note, all documents may not be applicable and our team will be reaching out with a personalized list after reviewing your application.

h2>Additional Tips for Making the Loan Process Easier:

- Keep copies of all documents related to the loan application and provide them to your loan officer in a timely manner

- Shop around for different lenders and compare loan offers before making a final decision

- Consider getting pre-approved for a loan to know how much you can afford to borrow before you start house hunting

- Read all loan documents carefully and ask questions if you don't understand something

- Stay in communication with your loan officer and respond promptly to any requests for additional information or documentation

Don't:

- Make large purchases on credit or take on any new debt during the loan process

- Apply for any new credit cards or loans, as this can negatively impact your credit score

- Close any existing credit accounts, as this can also negatively impact your credit score

- Make any major career changes, such as switching jobs or starting a new business, during the loan process

- Lie or misrepresent any information on your loan application, as this can lead to serious legal consequences.